HOME BUYER GUIDE

THE MASHBURN ZELL GROUP | ΓEA⅃ Broker

Buying a home isn’t just a transaction—it’s a journey. The Mashburn Zell Group is made up of Brian Zell, Samantha Zell, and Blake Mashburn. With over 50 years of combined experience, we’re here to guide, negotiate, cheerlead, and problem-solve until you have the keys

🔍 WHAT YOUR AGENT DOES

We’re not just here to unlock doors. With The Mashburn Zell Group, you’re getting a full-service team with decades of combined experience, hundreds of successful closings, and a sharp eye on what makes Ventura County tick. We’re not just here to help you find the right home—we’re here to protect your interests, guide your decisions, and advocate for you at every step.

Here’s what that actually looks like:

- ➤ Educate you on the market and trends

- ➤ Schedule and guide showings

- ➤ Craft strategic offers

- ➤ Negotiate on your behalf

- ➤ Manage timelines and contingencies

- ➤ Connect you with trusted vendors

- ➤ Support you emotionally (yes, that matters!)

We stay in your corner from first showing to final signature—and beyond. Whether it’s your first home or your fifth, we’re your lifelong partners in building real estate wealth, one chapter at a time.

STEP-BY-STEP HOME BUYING PROCESS

1. MEET YOUR AGENT

Let’s talk goals, timeline, and how this process works. We’ll also help you understand what the market is doing right now so you can plan wisely.

2. BUYER REPRESENTATION

We’ll go over the Buyer Representation Agreement, explain why it's required, and help you understand your rights as our client. We’ll walk you through all your options clearly and early—no surprises.

3. GET PRE-APPROVED

This isn’t just about how much you can borrow—it’s about what kind of loan is right for you, what rate range you qualify for, and what will make your offer stronger.

4. TOUR HOMES

We’ll point out resale value factors and red flags (like location quirks, future development plans, or dated major systems) so you can make informed choices.

5. MAKE AN OFFER

We’ll explain earnest money, contingencies, timelines, and how we structure your offer to make it competitive while still protecting your interests

6. ESCROW, DISCLOSURES, INSPECTIONS & APPRAISALS

This is where the paperwork gets real. We’ll help you interpret disclosures, understand your inspection options, and avoid costly surprises.

7. FINAL LOAN APPROVAL

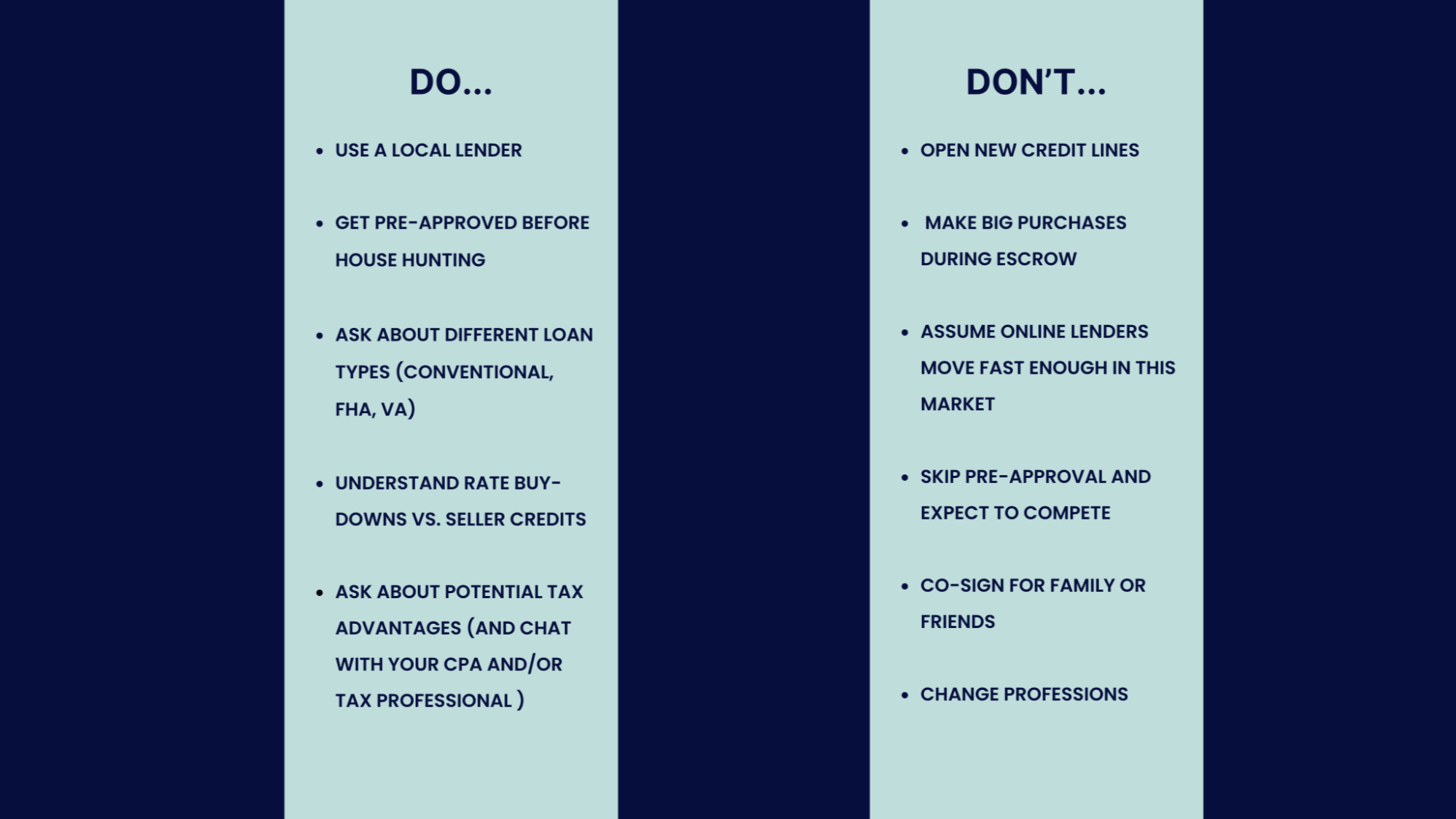

Once all documents are submitted and underwriting is complete, your lender will issue the Clear to Close. This means your loan is officially approved and we’re greenlit to close. No big purchases or credit changes now—coast it in!

8. FINAL WALKTHROUGH

We’ll confirm agreed-upon repairs are complete and that the home is in the expected condition. No surprises on the day you get the keys.

9. CLOSE & CELEBRATION

We’ll explain how funds are transferred, what happens on recording day, and how we track everything so you’re never left guessing.

| Day | What Happens |

|---|---|

| Day 1 | Escrow opens one day after acceptance. Earnest Money Deposit (EMD) is wired within 3 business days. Opening packages are sent. |

| Day 2 | Inspections and appraisal are ordered. Homeowner’s insurance process begins. |

| Day 3 | Earnest Money Deposit (EMD) is confirmed and processed by escrow. |

| Day 7 | Seller delivers disclosures. Buyer begins review while inspections are underway. |

| Days 10-14 | Inspections are completed. Buyer may request repairs, credits, or extensions. Appraisal results are in. |

| Day 17 | Contingencies are due. Loan, appraisal, inspection, and insurance contingencies are expected to be removed. |

| Day 25 | Closing Disclosure (CD) is delivered to the buyer by the lender. |

| Days 25-28 | Loan documents are signed by the buyer. Seller signs the grant deed. Escrow prepares the closing package. |

| Day 29 | Lender funds the loan. Escrow finalizes the file and prepares for recording. |

| Day 30 | Recording occurs. Buyer receives keys and takes possession of the property. |

|

Before you even start touring homes, getting your financing in order is key. |

|

FREQUENTLY ASKED QUESTIONS

Real estate can be complex—and buying a home is one of the biggest financial decisions of your life. We’re here to simplify it. Don’t hesitate to reach out to us with any and all questions.

| 1 | Do I really need to get pre-approved before touring homes? | Yes. Not only does pre-approval give you a clear idea of your budget, but in competitive markets, sellers often won’t consider offers without it. It shows you’re a serious and qualified buyer. |

| 2 | What’s the difference between a pre-qualification and a pre-approval? | Pre-qualification is a rough estimate based on self-reported info. Pre-approval is a more solid commitment from a lender based on verified income, credit, and assets. Always aim for pre-approval. |

| 3 | What happens if the home I want has multiple offers? | We’ll help you write a competitive offer based on price, terms, timing, and strategy. That might include increasing earnest money, limiting contingencies, or negotiating creatively. |

| 4 | What are closing costs, and how much should I budget? | Closing costs typically range from 2–5% of the purchase price. These include lender fees, escrow/title, insurance, and more. We’ll break it down for your situation—and sometimes negotiate for credits from the seller. |

| 5 | How long does the home buying process usually take? | From pre-approval to keys in hand, it usually takes 30–60 days. Timelines can vary based on your lender, inspections, and escrow, but we’ll keep everything moving on schedule. |

| 6 | Can I use gift funds for my down payment? | Yes! Many loan types allow gift funds from family members. Your lender will need a gift letter and documentation, but it’s a common (and welcome) way to help buyers get started. |

| 7 | Do I have to pay my agent out-of-pocket? | In most cases, no. We often negotiate for the seller to cover our commission—but either way, we’ll explain how it works in your Buyer Representation Agreement so it’s clear up front. |

| 8 | Can I back out after making an offer? | It depends on your contingencies. Inspection, appraisal, and loan contingencies all protect your right to cancel without penalty within specific timeframes. We’ll go over all of that before you make your offer. |

REAL ESTATE GLOSSARY

Real estate has a language of its own. So here is a simple glossary of terms we often use during the buying process. If ever we use a word you're unfamiliar with, just ask. We're here to translate.

HOME BUYER FAQ'S

Real estate can be complex—especially when it’s the biggest purchase of your life. We’re here to simplify it. Check out our FAQs, and don’t hesitate to reach out with any questions—we’re just a call, text, or DM away.

DOWNLOAD GUIDE

Want the full version to take with you? Get our complete Home Buyer Guide as a printable PDF—perfect for offline reading, note-taking, and sharing with family.